Waymo Coming to Atlanta: What Riders Need to Know

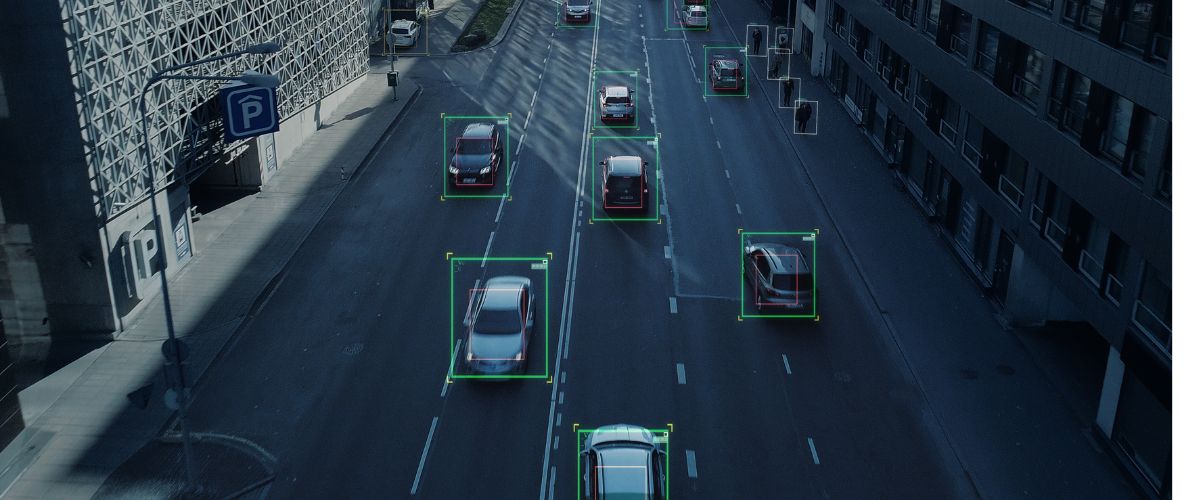

This summer you can expect to see fully self-driving Waymo One cars debuting on the streets of Atlanta. If you’re a rider who is interested in becoming one of the first to use the service, it is already available in the Uber app.